Do you ever pay off your credit card bill at the end of the month and wonder where your money has gone? After all, you make a good income, and you didn’t fly around the world in business class eating caviar for breakfast, lunch, and dinner! So, why is there no money left? For most people, it comes down to one thing: lack of budgeting.

Most people know what their after-tax paycheck is. If they earn a healthy enough salary, maybe they’re able to max out their 401(k) and pay off their credit card bill every month. So far, no issue, right? After all, if someone is able to save for retirement and pay all their bills every month, they should be good. The issue with that strategy is that you don’t create healthy savings habits. As your income grows, your expenses will likely grow at the same rate, and you will never increase the amount of money you save.

To create healthy savings habits, you must first understand where your money is going. To understand where your money is going, you guessed it, you have to create a budget. The goal with budgeting is not to track every single penny that is being spent, but rather to create target spending limits, so you know whether you overspent. You can think of budgeting as giving yourself permission to spend your own money. If you know the rest of your financial plan is on track, there is nothing wrong with spending your money and enjoying life!

There are three steps to follow to establish a budget and create healthy savings habits:

1. Categorize your spending: The first step is to figure out where the money is going after it hits your bank account. This is a two-part process:

- Use an account aggregator tool to see all your credit card and bank account transactions in one place. Using the tool is optional, but it prevents you from having to review all your credit card and bank statements separately. Most tools should allow you to link your accounts and track your expenses in one place. It should also allow you to categorize your spending, so you can see where your money is being spent (e.g., housing, transportation, dining out, groceries, etc.).

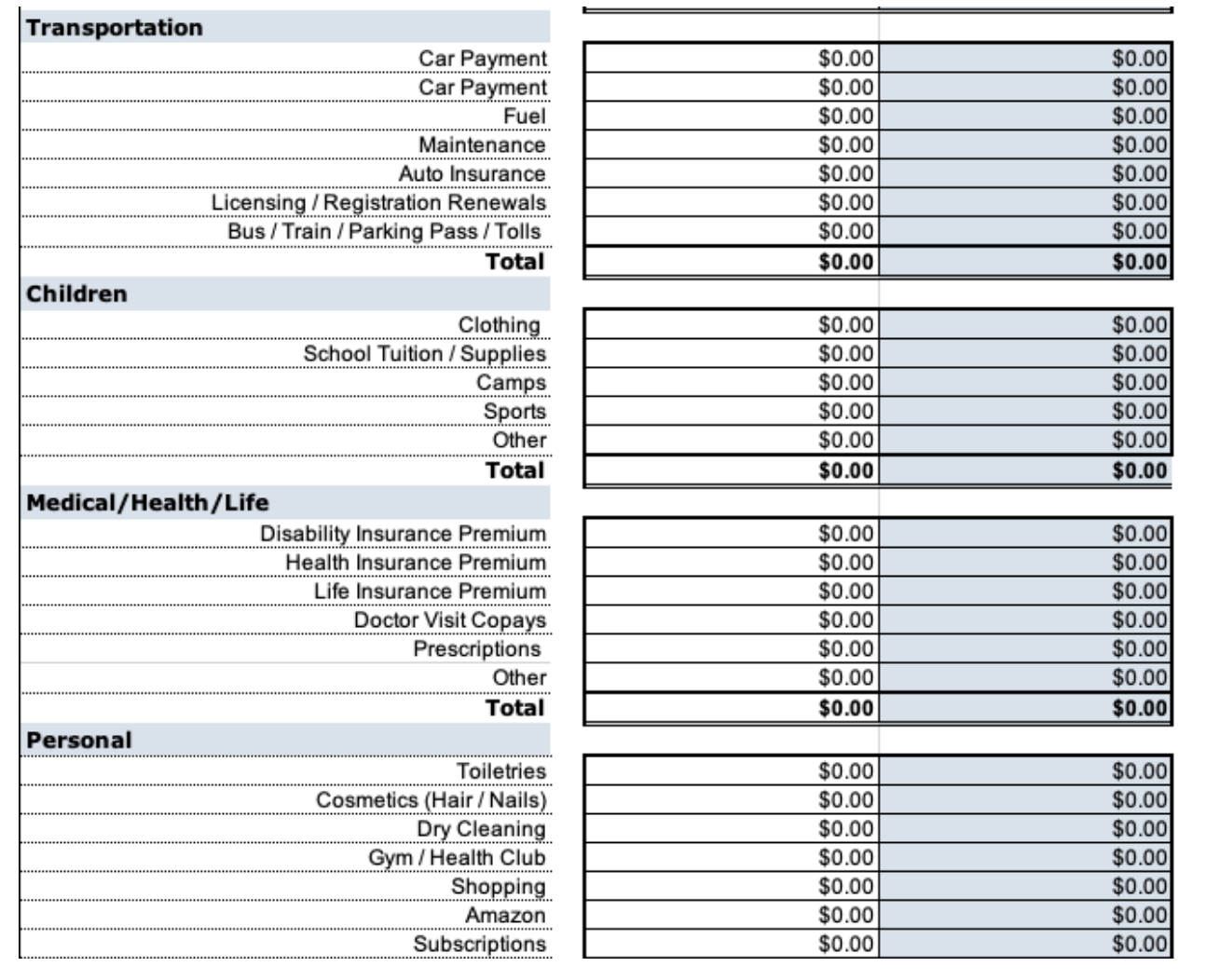

- Create a document and write down your monthly average spending for each category. This can be an excel spreadsheet, word document, or plain old paper (see example below). What I usually suggest is to total the last 90 days’ worth of transactions for each category (the aggregator tool should allow you to sort your transaction by dates) and divide that number by (3) to get the monthly average. This prevents your budget from being skewed one way or the other if your expenses were out of the ordinary for one of those months.

I also like to add a “buffer” spending category for miscellaneous items that just pop up randomly. For example, it’s hard to estimate things like car or home repairs, so you can just include those items into the buffer category.

2. Separate essential and discretionary expenses: After step 1, you should know where your money is being allocated across the different categories of spending. If you prefer keeping your current lifestyle unchanged, the monthly averages you calculated in step one become your spending targets. You know that if you spend within those targets every month, you are not overspending.

However, if your goal is to increase your savings by cutting expenses, simply knowing where your money is going is not sufficient. By further categorizing your spending between essential and discretionary expenses, it will be easier for you to see where you can cut back and where you simply cannot. For example, it’s much easier to cut back on food delivery services than it is to reduce your monthly mortgage or auto payment.

Another reason why I advocate for people to further categorize their spending into essential and discretionary expenses is because it makes it easier to determine how big of an emergency fund they need. I usually suggest keeping 3-6 months’ worth of essential expenses in a high-yield savings account.

3. Monitor your expenses: I get it, creating a budget is no fun. We all wish that we would only have to do this once and never have to think about it again. The reality is that we have to continuously track our expenses and update our budget. Two recommendations here:

As I mentioned above, most people have a good idea of what is coming into their bank account every month. Going through the three-step process above will allow you to determine what is coming out every month, and what is left over to allocate toward savings. Again, the goal with budgeting is not to track every penny being spent—that will drive you crazy. The goal is simply to know whether you are within your spending targets and hitting your savings goals. If there’s some money left over after that, there’s nothing wrong with splurging on something you can enjoy now!

- Review your credit card and bank transactions once per month. Doing this not only helps you see if you were within your spending targets for that month, but it also helps you notice potential fraudulent or erroneous transactions. I remember one time; I bought a meal at a restaurant and used one of those iPads to check out and tip the server. The restaurant was having technical issues with the iPad and the screen didn’t work. Had I not checked my credit card transactions for that month, I wouldn’t have realized that I tipped the server $220 for a $12 sandwich. I’m all about tipping well, but that’s a bit much!

- Review your budget once/year. The reason you want to review your budget is because life happens, and things change. Maybe your kids started playing a new expensive sport, or you bought a new car. This will help you stay on track with your savings goals.